Efficiency vs. Inclusion

Efficiency has long been FinTech’s favorite word. Every boardroom conversation, every investor deck, every new product announcement circles back to it—faster, smarter, cheaper. But let’s be honest: efficiency without inclusion is just speed for the few. India today has one of the most celebrated financial inclusion stories in the world. Over eighty percent of the population has a bank account. But look closer—one-third of those accounts are dormant, and only thirty-eight percent of rural households are digitally literate. We’ve built an incredible digital highway, but a large part of the country still stands at the toll gate, unsure how to drive. We’ve mistaken access for empowerment.

Inclusion isn’t just about having a bank account; it’s about being able to use it. If you can’t understand your bank, your bank doesn’t understand you. Digital banking has been designed by the literate, for the literate. Every step assumes English proficiency, comfort with navigation, and confidence in digital interfaces. For the elderly, the semi-literate, or those from rural areas, even “simplified” apps can feel like hieroglyphics.

We call it a user experience. They call it anxiety. The problem isn’t connectivity.

It’s comprehension.

When AI Starts Listening

For years, AI in finance has been about efficiency—detecting fraud, automating processes, and optimizing workflows. That’s the old story. The new story is accessibility. AI isn’t just about making machines smarter anymore—it’s about making humans more capable. It’s about understanding, not instructing. And the most natural way to do that? Voice. Typing is a skill. Speaking is instinct. When you let people transact in their own language, technology stops being intimidating and starts becoming empowering. Voice bridges what literacy divides.

For someone who’s never trusted a banking app, the first real sign of comfort comes when the system listens—and answers—without judgment or confusion.

If inclusion means dignity, then context is its foundation. Real conversations are rarely perfect; they’re messy, emotional, and personal. That’s exactly what machines must learn to handle.

The next step of inclusion isn’t about access—it’s about awareness. People don’t just want to transact; they want to understand their own financial behavior in plain language.

Language is identity, and India speaks in many at once. True inclusivity means understanding not only what people say, but how they say it—even when languages overlap and blur.

And sometimes, inclusion is about choice. Some moments need conversation, others need clarity. The best systems know when to speak and when to show.

The beauty of all these experiences is that they feel effortless—but what powers them behind the scenes is a carefully crafted ecosystem built on openness and intelligence.

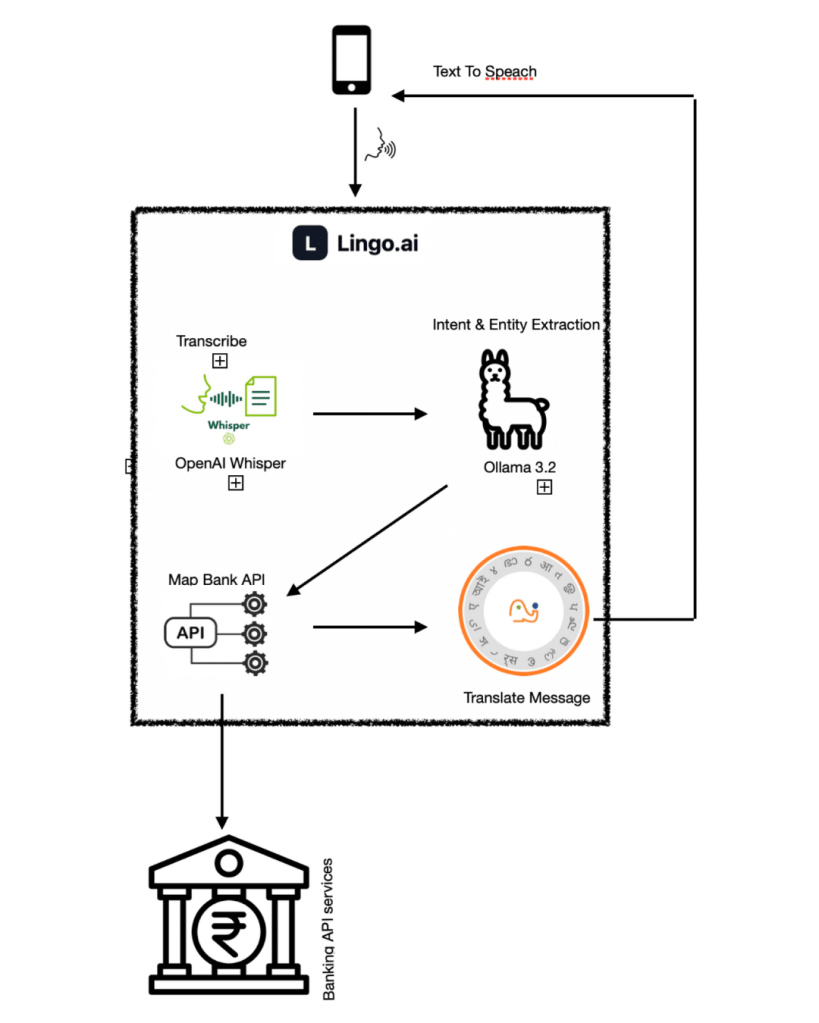

Ollama 3.2 orchestrates the models, OpenAI’s Whisper handles speech-to-text, and AI4Bharat ensures comprehension across Indian languages. Each detected intent maps to core banking APIs, and everything runs self-hosted within the bank’s infrastructure for compliance and privacy.

What truly matters, however, isn’t the tech stack—it’s the emotional one. You speak. It listens. You trust.

From Product to Principle

At Josh Software, we didn’t build a new app. We built a philosophy of inclusion. Every component is open-source, deployable within a bank’s infrastructure, and customizable for regional audiences. Because inclusion cannot be rented—it must be owned.

Reinforce that this isn’t a packaged product but a composable, integrable framework. Banks can host it internally, connect their own APIs, and tailor voice flows to regional contexts. The open-source foundation ensures control, compliance, and adaptability.] From voice-based balance checks and fund transfers to statement analysis and contextual UI responses, this system redefines accessibility.

It’s not for the tech-savvy. It’s for anyone who can say a sentence. That’s not disruption. That’s democratization. When an elderly woman can check her pension without help, when a migrant worker can send money without fearing a typo, when a farmer can hear his transaction summary in his own dialect—that’s not innovation.

That’s inclusion.

The Real AI Advantage

AI’s true promise in FinTech isn’t that it replaces humans—it’s that it helps more humans participate. It’s not about faster transactions; it’s about fairer ones. Because when banking begins to listen, something remarkable happens—people start to trust it again. We’ve spent years perfecting digital efficiency.

Now it’s time to make it inclusive. AI gives us that chance—not by eliminating humans, but by empowering them. The future of FinTech isn’t multilingual; it’s human-lingual.

Because the real AI advantage isn’t artificial intelligence—it’s applied inclusion.